Hey there! Have you been searching for a reliable and convenient digital payment solution in Nigeria? Well, look no further because I have just the thing for you! In this article, I’ll be sharing with you all the details about Moniepoint, Nigeria’s leading digital payment solution.

If you’re curious about how Moniepoint works, its benefits, and how to use it effectively, then stay tuned because you’re in the right place. Whether you’re a business owner looking to expand your payment options or an individual wanting a hassle-free way to make transactions, Moniepoint has got you covered. So, grab a cup of tea, sit back, and get ready to dive into this ultimate guide to Nigeria’s leading digital payment solution, Moniepoint!

Moniepoint Review: The Ultimate Guide to Nigeria’s Leading Digital Payment Solution

What is Moniepoint?

Moniepoint is a leading digital payment solution in Nigeria that allows users to make payments, send and receive money, and perform top-up and bill payments seamlessly. It is a convenient and secure platform that has revolutionized the way people in Nigeria conduct their financial transactions.

Overview of Moniepoint

Moniepoint was launched in Nigeria with the aim of providing a simple and efficient way for individuals and businesses to carry out their financial activities. It is powered by a robust technology infrastructure, ensuring reliability and security in every transaction. With its user-friendly interface and wide range of features, Moniepoint has quickly become the go-to digital payment solution for millions of Nigerians.

Features of Moniepoint

Moniepoint offers a plethora of features that make it a versatile and comprehensive payment solution. Here are some of its key features:

-

Easy Account Setup: Creating an account on Moniepoint is a breeze. Users can sign up using their mobile number and complete the registration process in just a few simple steps.

-

Bank Account Linking: Moniepoint allows users to link their bank accounts to their Moniepoint wallet. This feature enables seamless transfer of funds between the user’s bank account and their Moniepoint wallet.

-

Payment Options: Moniepoint supports various payment options, including card payments, bank transfers, and mobile money transactions. This ensures that users can choose the most convenient method for their transactions.

-

Bill Payments: With Moniepoint, users can easily pay their utility bills, such as electricity bills, water bills, and cable TV subscriptions, directly from their Moniepoint wallet. This eliminates the hassle of standing in long queues and provides a convenient solution for bill payments.

-

Top-Up Services: Moniepoint allows users to top up their mobile phones, purchase airtime, and data packages directly from their Moniepoint wallet. This feature ensures that users always stay connected and never run out of airtime or data.

-

Secure Transactions: Moniepoint employs state-of-the-art security measures to protect user data and ensure the safety of every transaction. Users can have peace of mind knowing that their personal and financial information is secure.

-

Wide Acceptance: Moniepoint is widely accepted across Nigeria, with a vast network of merchants and service providers. This means that users can use their Moniepoint wallet to make payments at various retail stores, restaurants, and online platforms.

How Moniepoint Works

Setting up a Moniepoint account is quick and easy. Here’s a step-by-step guide on getting started with Moniepoint:

Creating an Account

To create a Moniepoint account, simply download the Moniepoint app from the Google Play Store or Apple App Store. Once installed, open the app and click on the “Sign Up” button. Enter your mobile number, create a password, and verify your account through a one-time password (OTP) that will be sent to your registered mobile number.

Verifying your Account

After creating your account, you will need to verify your identity. This is a mandatory step to ensure the security of the platform and prevent fraudulent activities. To verify your account, provide the required personal information, such as your full name, date of birth, and government-issued identification details. Moniepoint will review your information and notify you once your account has been successfully verified.

Linking your Bank Account

Once your Moniepoint account is verified, you can proceed to link your bank account to your Moniepoint wallet. This will allow you to transfer funds between your bank account and your Moniepoint wallet seamlessly. To link your bank account, select the “Link Bank Account” option in the Moniepoint app and follow the instructions provided. You may need to provide your bank account details, such as your account number and bank name, to complete the linking process.

Using Moniepoint for Payments

Moniepoint offers a range of payment options that cater to different user preferences and needs. Here’s a closer look at how to use Moniepoint for various payment activities:

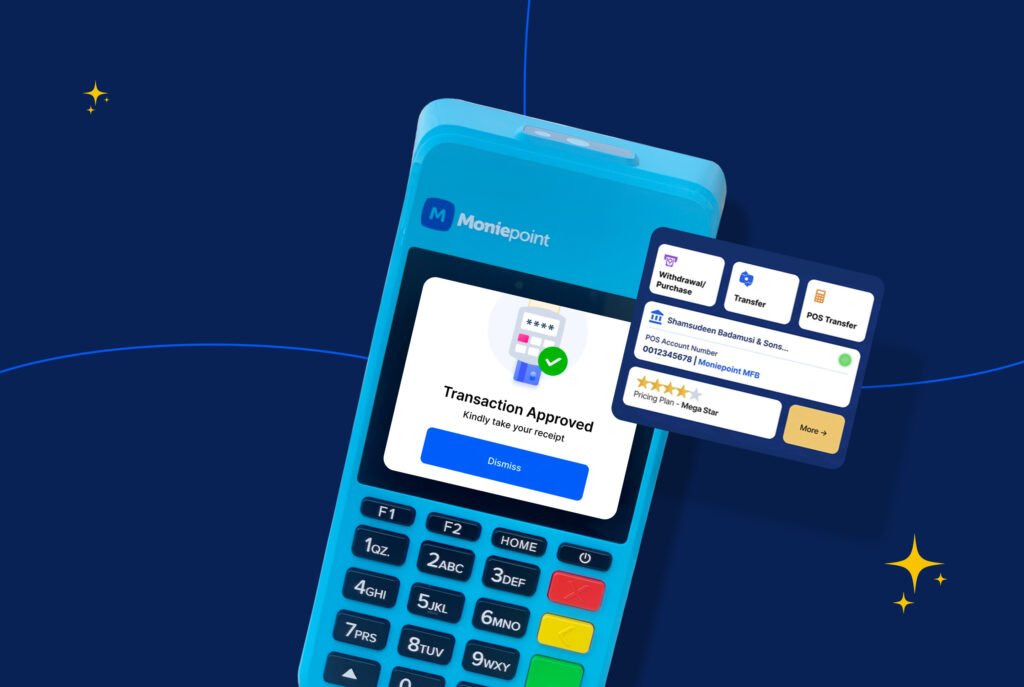

Making Payments

Making payments with Moniepoint is simple and convenient. Whether you’re shopping at a retail store, dining at a restaurant, or shopping online, you can use your Moniepoint wallet to make quick and hassle-free payments. Simply select the “Pay” option in the Moniepoint app, enter the amount to be paid, and authorize the transaction. The payment will be deducted from your Moniepoint wallet balance, and you will receive a notification confirming the successful payment.

Sending and Receiving Money

Moniepoint allows users to send and receive money from friends, family, and business associates with just a few taps on their mobile devices. To send money, select the “Send Money” option in the Moniepoint app, enter the recipient’s mobile number, and the desired amount to be sent. Confirm the transaction, and the recipient will receive the money instantly in their Moniepoint wallet. To receive money, simply provide your Moniepoint wallet number to the sender, who can then transfer the funds directly to your wallet.

Top-Up and Bill Payments

With Moniepoint, users can conveniently top up their mobile phones, purchase airtime, and data packages directly from their Moniepoint wallet. Additionally, Moniepoint offers the flexibility to pay various utility bills, such as electricity bills, water bills, and cable TV subscriptions, directly from the app. This eliminates the need to visit different service providers and ensures that users can manage all their top-up and bill payment needs from a single platform.

Moniepoint Agent Network

Moniepoint has an extensive network of agents across Nigeria, who play a vital role in expanding the reach and accessibility of the platform. Here’s more information on becoming a Moniepoint agent and the opportunities it offers:

Becoming a Moniepoint Agent

Becoming a Moniepoint agent can be a lucrative business opportunity for individuals looking to earn extra income. To become an agent, you will need to meet certain requirements set by Moniepoint, such as having a physical location for conducting transactions and meeting the necessary financial regulatory guidelines. Once approved as an agent, you will receive training and support from Moniepoint to effectively operate as a certified agent.

Earning Opportunities for Agents

As a Moniepoint agent, you can earn commissions on every transaction performed through your agent location. This includes fees charged for services like cash deposits, withdrawals, and fund transfers. The more transactions you process, the higher your earning potential. Moniepoint also offers additional incentives and rewards for agents who achieve specific performance targets, motivating agents to provide excellent service and attract more customers.

Agent Benefits and Support

Moniepoint provides comprehensive support and benefits to its agents to ensure their success. Agents receive training on how to use the Moniepoint platform, handle transactions, and resolve customer inquiries effectively. Moniepoint also provides marketing materials and assistance to agents to attract customers and increase footfall at agent locations. Agents have access to a dedicated support team that provides assistance and guidance whenever needed.

Security and Customer Support

Security is a top priority for Moniepoint, and the platform is equipped with robust security measures to protect user data and prevent fraudulent activities. Here’s an overview of the security measures implemented by Moniepoint:

Security Measures

Moniepoint uses advanced encryption technologies to safeguard user data and ensure secure transmission of information. Additionally, Moniepoint regularly conducts security audits and vulnerability assessments to identify and patch any potential security loopholes. Users can be confident that their personal and financial information is protected at all times.

Fraud Prevention

Moniepoint employs stringent fraud prevention measures to detect and prevent fraudulent activities on the platform. This includes real-time monitoring of transactions for suspicious activities and the implementation of artificial intelligence algorithms to identify patterns indicative of fraudulent behavior. In the event of any suspicious activity, Moniepoint takes immediate action to investigate and resolve the issue.

Customer Support Services

Moniepoint provides dedicated customer support services to assist users with any issues or inquiries they may have. Users can reach out to the customer support team through various channels, such as phone, email, and live chat support. The support team is available 24/7 and strives to provide prompt and effective resolutions to customer queries.

Comparison to Other Payment Solutions

Moniepoint stands out as a leading digital payment solution in Nigeria, offering several advantages over traditional banks and other mobile payment apps. Here’s a comparison of Moniepoint with other payment solutions:

Comparison to Traditional Banks

Unlike traditional banks, Moniepoint offers a seamless and convenient user experience. With Moniepoint, users can open an account and carry out their financial transactions without having to visit a physical branch. Moniepoint also provides a wider range of payment options, including mobile money transactions and bill payments, which may not be available through traditional banks. Additionally, Moniepoint’s extensive agent network allows users to access their services in even the most remote areas of Nigeria, where traditional banks may not have a presence.

Comparison to Other Mobile Payment Apps

While there are several mobile payment apps available in Nigeria, Moniepoint offers unique features and benefits that set it apart. Moniepoint’s wide acceptance across various merchants and service providers gives it a competitive edge. Additionally, Moniepoint’s focus on security and fraud prevention ensures that users can conduct their financial transactions with confidence. The ease of use and user-friendly interface of the Moniepoint app further contribute to its popularity among users.

Unique Features of Moniepoint

Moniepoint offers several unique features that make it the preferred choice for millions of Nigerians. Some of these features include the ability to top up mobile phones and make bill payments directly from the app, as well as the extensive agent network that ensures accessibility in even the most remote areas. Moniepoint’s dedication to security and customer support further enhances its appeal to users.

User Reviews and Feedback

To gauge the user experience and satisfaction levels, we delved into user reviews and feedback regarding Moniepoint. Here’s a summary of the user sentiment:

Positive User Reviews

Many users appreciate the simplicity and convenience of using Moniepoint for their financial transactions. The ease of setting up an account, making payments, and sending/receiving money were highlighted as key advantages. Users also praised Moniepoint’s wide acceptance, which allowed them to use the platform at various retail outlets and online stores. The security measures implemented by Moniepoint were highly appreciated, with users expressing confidence in the platform’s ability to protect their personal and financial information.

Negative User Reviews

While the majority of user reviews were positive, there were some instances where users faced challenges with certain transactions or experienced delays in customer support response time. However, Moniepoint is actively addressing these concerns and working towards providing the best possible user experience and customer support.

Customer Feedback

Moniepoint values customer feedback greatly and is consistently working towards improving its services based on user suggestions and requests. Users are encouraged to provide feedback through the app or reach out to the customer support team with any concerns or recommendations.

Expansion and Future Plans

Moniepoint has experienced significant growth since its launch and has ambitious plans for the future. Here’s a glimpse into Moniepoint’s growth strategy and expansion plans:

Moniepoint’s Growth Strategy

Moniepoint aims to continue expanding its user base and merchant network across Nigeria. The platform plans to introduce new features and enhancements to further simplify and enhance the user experience. Moniepoint is also looking to collaborate with more banks, financial institutions, and service providers to broaden its offerings and reach.

Plans for International Expansion

While Moniepoint currently focuses on serving the Nigerian market, there are plans for international expansion in the future. Moniepoint aims to bring its innovative payment solution to other African countries, where access to reliable and efficient digital payment solutions is of utmost importance.

Partnerships and Collaborations

Moniepoint recognizes the value of partnerships and collaborations in driving growth and innovation. The platform actively seeks strategic partnerships with banks, financial institutions, and technology companies to create synergies and offer enhanced services to its users.

Conclusion

In conclusion, Moniepoint is undeniably Nigeria’s leading digital payment solution, providing users with a convenient, secure, and versatile platform to carry out their financial transactions. With its wide range of features, ease of use, and dedicated customer support, Moniepoint has become an indispensable tool for millions of Nigerians.

Whether it’s making payments, sending and receiving money, or managing top-up and bill payments, Moniepoint offers a comprehensive solution that caters to the varying needs of individuals and businesses. With its growing agent network and plans for future expansion, Moniepoint is well-positioned to further revolutionize the digital payment landscape in Nigeria and beyond.

I highly recommend Moniepoint to anyone looking for a reliable and efficient digital payment solution in Nigeria. Give it a try and experience the convenience and security that Moniepoint offers.