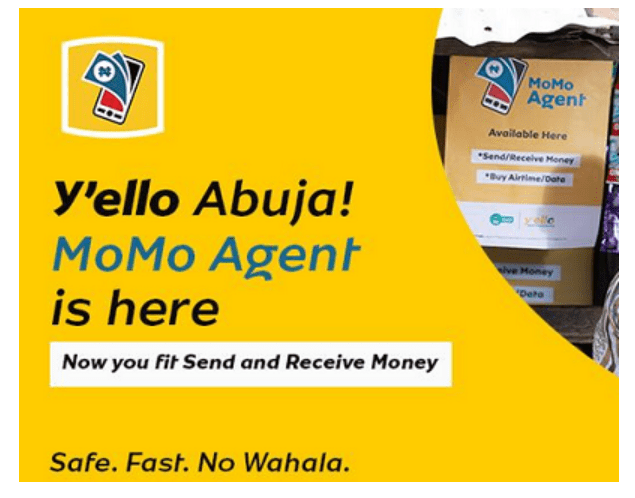

The Nigeria’s biggest telecoms firm MTN has launched a mobile cash transfer service, which is the MTN MoMo mobile money operations in Nigeria, It has been said that Nigeria has the biggest market and Africa’s most inhabited nation. This new project is focused on those having no bank accounts.

This new development is as a result of the achievements in east Africa of M-Pesa, the portable cash unit of Kenya’s Safaricom, which has persuaded speculators and the business that money related administrations is the next big thing in the development territory for the telecoms area, where the costs for basic services are decreasing rapidly.

- Related Posts….

- WhatsApp Pay: send and receive money via chat messenger

- Xoom: How to send Paypal money directly to your bank account

- Ayoba: New Mtn Chat Messenger said to Rival WhatsApp and Telegram

Some key areas of the MTN MoMo mobile money services will be:

- Customers will be able to send text messages for free and get an immediate response giving them a rundown of enrolled operators close them.

- Customers will be able to pay transfer sum to operators who will in turn give them a code that will be sent to the beneficiary. Then the beneficiary will go to any agent close to them and collects the money.

- The sender will be charged 100 naira however. N50 will go to the sending operator and the paying agent will likewise get N50.

- The Minimum amount of money that can be sent is N100 while the maximum amount that can be sent ranges from N50,000 to N100,000 depending on the agent.

- The beneficiary must however collect the money within 30 days or he/she will risk loosing the voucher which will expire.

One key issue raised by a previous top government employee has been the 100 naira charge on the services rendered by MoMo which he says is about twofold the 52 naira charged on a normal mobile banking transactions.

Observing the MoMo operations in Ghana, you can utilize MTN Mobile Money to send and receive cash, recharge your MTN line, pay subscription fees (DStv, ECG Postpaid, MTN Postpaid, School expenses and many other subscription fees), purchase and pay for insurance, pay workers salaries, acquire airline tickets and alternative merchandise and services.

- Other Related Posts…

- 4 Ways To Fix GTBank Dispense Error

- Dstv and Gotv sets to slash subscription Fees in some African

- WhatsApp Trick to Reveal the Exact Number of Texts You’ve sent to Anyone.